Debt Management Vs Debt Settlement

The journey to financial success in America is often complicated for South Asian Americans. Many navigate a unique set of pressures, from balancing family expectations for wealth and support to managing the financial demands of remittances sent back home or the complex commitment of co-signing loans for relatives. Amidst these responsibilities, high-interest unsecured debt—like credit cards—can quickly become overwhelming. For a community that often prioritizes reputation and financial stability, being trapped in debt carries not only a financial burden but a significant emotional one.

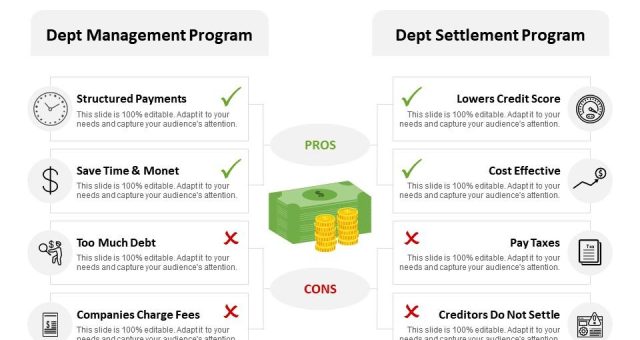

The good news is that you have options to gain control. The two most common and effective pathways for reducing unsecured debt are a Debt Management Plan (DMP) and Debt Settlement (DS). While both offer a way out, their methods, impact on your credit, and overall costs are drastically different.

This guide provides a clear, side-by-side, and culturally sensitive comparison of Debt Management versus Debt Settlement. We will examine the pros, cons, and long-term implications of each, empowering you to choose the financial path that best honors your values and secures your future in the United States.

Understanding Your Unique Financial Landscape

For many South Asian immigrants and first-generation Americans, managing finances in the U.S. involves navigating an intricate blend of immigrant financial norms and American consumer culture. You’re not just managing your own budget; you’re often balancing obligations that stretch across continents, which can dramatically change your debt risk profile. A solution that works for the general American public might not account for your specific needs, particularly concerning long-term financial reputation and goals like securing a Green Card or establishing a stable, multi-generational home.

Common Debt Triggers in the South Asian American Community

The path to accumulating debt often looks different within your community. Understanding these specific triggers is the first step toward effective relief:

- Establishing Credit: Newly arrived professionals, including those on H-1B visas, often rely on credit cards and personal loans to quickly build a “good credit” score—a necessity for renting or buying a home. Aggressive use to accelerate this process can lead to spiraling high-interest debt.

- Small Business Ventures: Entrepreneurship is common, but funding for family-owned franchises or start-ups often involves high-interest commercial debt or leveraging personal credit and assets.

- Financial Commitments to Family: Supporting family overseas through remittances or taking on the burden of co-signing loans for relatives in the U.S. can suddenly place a large, unexpected liability on your shoulders.

- High Cost of Living: Settling in high-cost metro areas with established South Asian communities means housing, education, and social spending often strain budgets, pushing many to rely on credit.

The Cultural Stigma of Debt

In many South Asian cultures, an untarnished reputation, or “izzat,” is paramount. Financial struggles are often hidden from family and community members, as they are mistakenly viewed as a personal failure. This cultural stigma of debt prevents many from seeking help until the situation is critical, leading to higher interest costs, deeper credit damage, and immense stress.

Expert Note: Let go of the shame. In America, seeking professional debt relief is a responsible and powerful financial decision. It is a calculated move toward building a stronger, more secure future for yourself and your family. Your priority should be finding the solution that protects your long-term stability and preserves your credit in the long run.

Deep Dive into Debt Management Plans (DMP)

A Debt Management Plan (DMP) is often viewed as the responsible, structured approach to debt relief. It is not a loan, but rather a formal repayment agreement set up by a certified, usually non-profit credit counseling agency. This path is designed for individuals who are committed to fulfilling their entire financial obligation but need help making it affordable and manageable.

How a Debt Management Plan Works?

When you enroll in a DMP, you work directly with a non-profit credit counseling agency. This is a key distinction, as their focus is on your financial well-being, not generating profit from your debt. The agency takes over the administrative burden by:

- Negotiating Lower Interest Rates: The counselor contacts your unsecured creditors (like credit card companies) and negotiates to drastically reduce or eliminate interest rates and waive late fees. This is a powerful tool, as it ensures almost all of your monthly payment goes toward the principal.

- Consolidating Payments: Instead of juggling multiple bills with different due dates and interest rates, you make one single monthly payment to the credit counseling agency. The agency then disburses the appropriate funds to each of your creditors. This simplifies your budget and removes the risk of missing payments.

- Full Repayment of Principal: It’s important to understand that a DMP is a full repayment program. You agree to pay 100% of the principal debt you owe.

- Typical Duration: A successful DMP usually takes three to five years to complete, after which you are officially debt-free.

Pros and Cons of Debt Management

A DMP is a powerful tool, but it’s essential to weigh its benefits against its limitations, particularly with long-term financial goals in mind:

| Advantage (Pros) | Disadvantage (Cons) |

| Credit Preservation: Accounts are generally reported as “paid as agreed through a counseling program.” While it is noted on your report, the long-term damage is minimal, and your score can improve once the program is complete. | No Reduction of Principal: You must commit to repaying the full original amount owed, even if interest is drastically reduced. |

| No Tax Implications: Since no debt is forgiven or canceled, you do not receive a 1099-C form and face no tax liability for your debt relief. | Account Closure: Creditors usually require you to close the accounts enrolled in the plan, restricting access to those credit lines during the repayment period. |

| Structure and Education: The non-profit agency provides ongoing financial education and budgeting support, which helps you build long-term responsible spending habits. | Strict Compliance: The plan requires consistent, timely payments. Falling behind can lead to creditors dropping your accounts from the program, undoing the interest rate concessions. |

| Stops Collection Calls: Creditors generally stop collections and harassing calls once they agree to the terms of the plan. |

Who is a DMP Best For?

A Debt Management Plan is ideal for the South Asian American professional or family who:

- Has a stable and sufficient income to cover the reduced monthly payments and can realistically afford to repay the entire principal debt.

- Prioritizes preserving their credit score for major purchases soon after the program ends, such as securing a mortgage to buy a home or obtaining a new vehicle loan.

- Values honor and integrity in repayment and feels strongly committed to paying back 100% of what was borrowed.

- Seeks a holistic solution that includes financial education and budgeting assistance to prevent future debt accumulation.

A DMP is a responsible path that aligns with long-term financial stability and minimizes negative repercussions on your American financial profile.

Deep Dive into Debt Settlement (DS)

Debt Settlement (DS), also known as debt negotiation, is a high-risk, high-reward strategy used to resolve unsecured debt for less than the full amount owed. Unlike a Debt Management Plan (DMP), this path is typically facilitated by for-profit companies whose primary goal is to maximize the discount on your debt. While it promises faster debt freedom and a lower total payout, it comes with significant financial and credit consequences that must be carefully considered, especially for South Asian Americans focused on establishing a strong life in the U.S.

How Debt Settlement Works?

Debt settlement companies approach the process by creating a scenario that forces your creditors to accept a reduced payment:

- Stopping Payments: The core strategy involves advising you to stop making payments to your original creditors and instead deposit funds into a dedicated, often FDIC-insured, escrow-like savings account. This deliberate delinquency harms your credit but signals to creditors that you are in severe financial distress.

- Building a Lump Sum: You continue making regular deposits to this special account until enough money has accumulated for the settlement company to negotiate a lump-sum payment. Creditors are generally more willing to settle for a lower amount (often 40% to 70% of the original balance) than risk receiving nothing if you were to declare bankruptcy.

- Negotiation and Payment: Once a lump sum is negotiated, the settlement company pays the creditor, and your account is marked as “settled” for less than the full amount. This process can take anywhere from two to four years, but is usually faster than a DMP.

- High Fees: The settlement company’s fees are typically a percentage of your original enrolled debt or the amount saved, and are only paid after a settlement is achieved.

Pros and Cons of Debt Settlement

Because DS involves not paying your creditors as agreed, the short-term relief is often balanced by severe long-term consequences:

| Advantage (Pros) | Disadvantage (Cons) |

| Significant Debt Reduction: You pay back only a fraction of the principal debt (e.g., $6,000 on a $10,000 balance), offering immediate relief from overwhelming totals. | Severe Credit Damage: Your accounts will be marked as “settled” or “charged off.” This remains on your credit report for seven years from the date of the original delinquency, severely impacting your ability to secure loans. |

| Faster Resolution: The entire process is usually completed quicker (2–4 years) than a DMP, allowing you to become debt-free faster. | Risk of Lawsuits: While negotiating, creditors may file lawsuits against you to recover the full debt. The settlement company offers no guarantee against this. |

| Reduced Stress (Eventually): Once the settlement is complete, you are free of the debt and the cycle of minimum payments. | Tax Implications (1099-C): The amount of debt that is forgiven may be counted as taxable income by the IRS, requiring you to pay income tax on the difference. |

| Fees and Hidden Costs: Settlement company fees are high, and the process of stopping payments can incur late fees and collection costs from the creditor before a settlement is reached. |

Who is DS Best For?

Debt Settlement is an option of last resort, best suited for the individual in the South Asian American community who:

- Is facing extreme financial hardship (such as unemployment, business failure, or major medical crisis) and genuinely has no ability to pay back the full amount of debt.

- Has already damaged credit (scores below 600) and is not concerned about further, immediate credit impact, but needs a fresh start.

- Requires the fastest possible way to reduce a crushing debt load to manageable levels, even at the cost of long-term credit rebuilding.

- Has a large volume of unsecured debt ($10,000 or more) and has consulted with both a financial professional and a tax advisor to fully understand the risks, including the 1099-C tax liability.

The Crucial Comparison: DMP vs. DS

Choosing between a Debt Management Plan (DMP) and Debt Settlement (DS) is the most critical step in your debt relief journey. It is a decision that dictates not only how much you will pay but how quickly and completely you can rebuild your financial foundation in the U.S. Below is a detailed, objective comparison of the three most important factors: credit impact, total cost, and the surprising hurdle of taxes.

Credit Score Impact: Long-Term Stability vs. Immediate Damage

The effect on your credit report is the clearest difference between these two options. If your goal is to preserve your eligibility for future major financial decisions (like a home mortgage, which is often a key aspiration for South Asian families), the choice is straightforward.

| Feature | Debt Management Plan (DMP) | Debt Settlement (DS) |

| Credit Report Notation | Account is typically reported as “paid as agreed through a credit counseling program.” | Account is reported as “settled for less than the full balance,” “charged off,” or “in collections.” |

| Short-Term Impact | Minimal initial impact; a temporary drop may occur when accounts are closed, which increases your credit utilization rate. | Severe negative impact. The required step of intentionally missing payments causes immediate, significant damage to your score. |

| Long-Term Impact | Positive. On-time, consistent payments within the plan improve your payment history, allowing your score to recover and climb back up faster (often by the time the plan ends). | Long-lasting negative impact. The “settled” status and delinquencies remain on your report for up to seven years from the date of the first missed payment, making all forms of credit expensive or inaccessible during that period. |

Cost & Repayment: 100% Principal vs. Negotiated Principal

Many are initially drawn to Debt Settlement because of the promise of paying less, but it’s vital to compare the total financial outlay of both options:

- Debt Management Plan (DMP): You pay 100% of your principal debt, plus small, regulated monthly administrative fees to the non-profit agency (typically under $50). You save a substantial amount of money by having your interest rates lowered from high double-digits down to single-digits or even zero.

- Debt Settlement (DS): You pay 40% to 70% of the principal debt. This is a major saving on paper. However, you must add the settlement company’s fees (usually 15% to 25% of the original enrolled debt) to that cost. Furthermore, because you spend months not paying your creditors, they add substantial late fees and penalty interest before the settlement is reached. In the end, the true “savings” are often much less than advertised, and the risk is far higher.

Tax Implications: The Forgotten Cost of Forgiven Debt

This is perhaps the most overlooked and dangerous factor of Debt Settlement and is a critical point for any major financial decision (YMYL):

- Debt Management Plan: There are no tax implications. Since you repay 100% of the original principal debt, nothing is forgiven or canceled, and you will not receive any tax forms related to the debt relief.

- Debt Settlement: The amount of debt your creditor forgives (the difference between what you owed and what you settled for) is considered taxable income by the IRS. If this amount is $600 or more, the creditor is legally required to send you a Form 1099-C (Cancellation of Debt) and report it to the IRS.

This means if you settle a $10,000 credit card balance for $5,000, that $5,000 difference is added to your income for that tax year. This sudden “income” could push you into a higher tax bracket and result in a surprise tax bill that negates a large portion of your savings. While exceptions like insolvency may apply (using IRS Form 982), navigating this process is complex and risky.

Expert Advice: If you are considering Debt Settlement, you must consult with a tax professional (a CPA or enrolled agent) before you enroll. They are the only experts who can accurately assess the potential tax liability from Form 1099-C and advise you on claiming any applicable exceptions. Do not rely solely on the settlement company’s advice for tax matters.

A Responsible Path Forward: Expert Recommendations and Next Steps

You now understand the fundamental differences and risks associated with Debt Management and Debt Settlement. The final, and most crucial, step is to move from information to action with professional guidance. Don’t make this life-altering decision alone.

Start with a Confidential Financial Assessment

The biggest barrier for many in the South Asian community is the cultural value of privacy; discussing debt often feels like admitting failure. We want to assure you that seeking professional assistance in the U.S. is confidential, non-judgmental, and secure.

Your first step should be to engage with a professional, third-party, non-profit credit counseling agency for a comprehensive financial assessment. These counselors are trained to review your entire financial profile—income, assets, liabilities, and goals—to determine your true capacity to pay. They will offer an unbiased recommendation, telling you if a Debt Management Plan is feasible, or if your situation is severe enough that Debt Settlement (or even bankruptcy) should be considered as a last resort. This initial consultation is typically free and provides the clarity you need without obligation.

The Expert Checklist for Choosing a Provider

When you are ready to move forward, vetting your chosen debt relief provider is critical. Given the high-stakes nature of this financial decision, look for these markers of authority and trustworthiness:

- Provider Status: For a DMP, verify the organization’s non-profit status. For Debt Settlement, understand that providers are for-profit companies, but ensure they are properly registered to do business in your state.

- Accreditation and Licensing: Look for industry certifications and accreditations. For DMPs, check membership in organizations like the National Foundation for Credit Counseling (NFCC). This confirms they operate under strict ethical standards.

- Transparent Fees: Demand a clear, written explanation of all fees. DMP fees are low and standardized; DS fees are a percentage of debt and can be very high.

- Communication & Support: Since debt involves intense negotiation and long-term commitment, ensure the provider offers clear communication and, ideally, staff or resources that are sensitive to your specific cultural or linguistic needs.

Your Financial Future in the USA

The conflict between Debt Management and Debt Settlement boils down to a choice between two outcomes:

- Debt Management (DMP): The responsible path for credit preservation and full repayment. You pay 100% of the principal, save massively on interest, and exit debt with your credit score intact, ready for major life milestones.

- Debt Settlement (DS): The last-resort path for extreme debt reduction at a severe cost. You pay less principal, but you take a major, seven-year hit to your credit and face the potential complication of taxable debt forgiveness (1099-C).

Taking control of your debt is not a sign of failure; it is the ultimate expression of strength and forward planning. It means you are prioritizing your family’s future over short-term shame. Choose the path that aligns with your long-term goals in America, get expert help today, and take a bold step toward the financial security you deserve.