Gross or Net Income: What Is The Difference?

Are you tracking your expenses against the wrong number?

For South Asian families balancing remittances, property investments back home, and the rising cost of living in the USA, confusing your Gross and Net income can lead to significant financial setbacks and increased debt. Managing finances in the US is uniquely complex, especially when navigating a new tax system and balancing overseas financial commitments with local expenses.

Many professionals, whether recently arrived or established, make the critical mistake of budgeting with the large, impressive number—your Gross Income—only to find their bank account short at the end of the month. This simple error can dangerously inflate your perceived financial stability, pushing you toward an unsustainable debt-to-income ratio (DTI) and compounding debt issues.

As a debt relief and financial management expert, our goal is to help you gain absolute clarity over your money. We understand the complexity of the US payroll system. By accurately defining and calculating your Net Income, you unlock the true figure available for day-to-day living, saving, and, most importantly, aggressively tackling debt. This guide clarifies the difference and shows you exactly how to use your Net income to achieve financial freedom. Knowing your paycheck is the absolute foundation for a debt-free future.

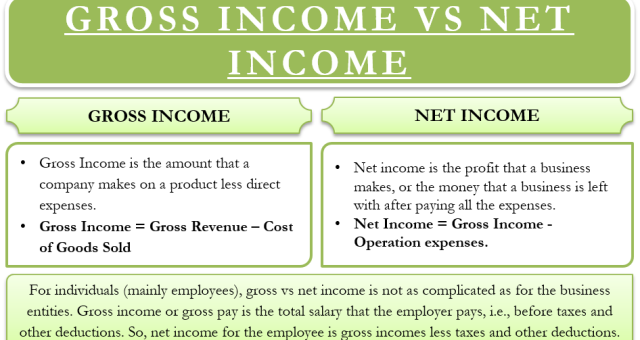

Gross Income Explained: The Full Financial Picture

Your Gross Income is the total amount of money you earn before any taxes, deductions, or adjustments are taken out. Think of it as your entire financial harvest for a given period—whether that’s a week, a month, or a year.

This figure includes all forms of compensation from your employer: your base wages or salary, along with any bonuses, tips, or commissions. If you have income from other sources, like rent from a property or investment dividends, these also contribute to your overall annual gross income.

It is critical to note what Gross Income is not. It typically does not include reimbursements for business expenses (like travel or supplies) because that money is simply an employer paying you back, not actual earnings.

In the US, your annual Gross Income is the figure prominently displayed on your W-2 Form—it’s the amount your employer reports to the IRS as your total earnings before any deductions. This number is extremely important to external parties, particularly lenders, when you apply for major credit like a mortgage, a car loan, or certain credit cards. They use your Gross Income to calculate your capacity to take on debt, regardless of what you actually take home.

The Bridge: Mandatory and Voluntary Deductions in the US Payroll System

The difference between your substantial Gross Income and your actual take-home pay lies in the necessary financial bridge known as deductions. These are the items subtracted from your gross earnings to calculate your Net Income. Understanding these deductions is key to accurate budgeting and long-term financial planning.

Mandatory Deductions (Non-Negotiable)

These are amounts required by federal and state law and are automatically withheld from your paycheck.

- Federal Income Tax: This is the tax paid to the U.S. government based on your earnings. The amount withheld depends on your income level and the information you provide on your W-4 form. The US system uses tax brackets, meaning different portions of your income are taxed at progressively higher rates.

- State and Local Taxes: Most states and some cities also require income tax withholding. This rate varies significantly—some states have no state income tax, while others have high rates.

- FICA Taxes (Social Security and Medicare): The Federal Insurance Contributions Act (FICA) funds two vital government programs. Social Security provides retirement benefits, and Medicare provides health insurance for the elderly. These are often seen as contributions to your future safety net and are generally non-negotiable up to a certain income cap.

Voluntary Deductions (Negotiable)

These are elective contributions you authorize your employer to take out, often offering a significant tax advantage.

- Retirement Contributions: Deductions for accounts like a 401(k) (common in for-profit companies) or a 403(b) (common in non-profit and educational settings) are subtracted pre-tax. This lowers your taxable income, meaning the government calculates your income tax on a smaller number, effectively giving you a tax break today while you save for the future.

- Health Insurance Premiums: If you receive health coverage (such as a PPO or HMO plan) through your employer, your portion of the monthly premium is typically deducted pre-tax.

- Tax-Advantaged Accounts: Contributions to accounts like a Health Savings Account (HSA) or a Flexible Spending Account (FSA) are powerful tools that allow you to set aside funds pre-tax to pay for qualified medical expenses.

All these mandatory vs. elective contributions collectively determine your transition from Gross Income to your actual, usable Net Income.

Net Income Explained: Your True Financial Foundation

Your Net Income, often called your “take-home pay,” is the money that actually lands in your bank account. After navigating the complexities of taxes and mandatory contributions, this is the figure you truly have available to manage your financial life.

The calculation is straightforward:

This final amount is your single most important number for personal finance. It forms your true financial foundation. This is the only number you should use when sitting down to create a realistic household budget, tracking your monthly cash flow, and—most critically—determining how much you can afford to put toward debt repayment, savings, or investments. Using your Gross Income for budgeting is the fast track to a deficit.

To ensure the accuracy of this vital number, we strongly advise a diligent practice: always check your pay stub. Reviewing your pay statement ensures that the correct amounts are being withheld for taxes, retirement contributions, and insurance premiums. If any deduction seems incorrect, addressing it immediately can prevent financial shortfalls and promote crucial financial diligence. Your Net Income is your reality, and managing it responsibly is the cornerstone of debt relief.

Case Study: Calculating the Difference for a US-Based South Asian Family

To see the real-world impact of deductions, let’s walk through a common scenario for a South Asian household in the United States.

Consider a professional couple whose combined annual Gross Income is $150,000. One spouse may be here on an H-1B visa, while the other holds a Green Card or citizenship. Their financial goals likely include sending remittances back home, saving for children’s college, and potentially paying down a mortgage or student loans.

It is tempting to budget based on that impressive $150,000 figure, which breaks down to an appealing $12,500 per month. However, watch how quickly that number shrinks after taxes and contributions are subtracted:

| Deduction Type | Monthly Amount | Notes |

| Mandatory Taxes (Estimated) | ||

| Federal, State, and FICA Taxes | -$3,500 | Based on average effective tax rates for this income level and location. |

| Voluntary Pre-Tax Deductions | ||

| 401(k) Retirement Contribution | -$1,000 | A strategic contribution to lower taxable income and build wealth. |

| Health Insurance Premiums | -$400 | Cost for a family plan deducted pre-tax. |

| Total Deductions | -$4,900 |

The Critical Difference

| Income Metric | Monthly Value |

| Gross Income (Starting) | $12,500 |

| Total Deductions | -$4,900 |

| Net Income (Take-Home Pay) | $7,600 |

The difference is staggering. While the Gross Income is $12,500, the family’s actual Net Income is only $7,600. That is a difference of $4,900 that never hits the bank account.

If this couple budgets for a mortgage, car payment, and lifestyle based on the $12,500 Gross figure, they will quickly face a $4,900 shortfall every single month—leading directly to debt accumulation. The takeaway is clear: your budget must be built on the $7,600 Net Income, not the $12,500 Gross Income.

Strategic Financial Management: Using Net Income to Crush US Debt

Understanding the difference between Gross and Net Income is not just an academic exercise; it is the strategic foundation for achieving debt relief. Your Net Income is the vital fuel for responsible financial management.

Once you know your true take-home pay, you can implement proven budgeting methods, such as the 50/30/20 Rule (50% on needs, 30% on wants, 20% on savings/debt) or Zero-Based Budgeting, to direct every dollar with purpose.

Avoiding the DTI Trap

It is essential to understand the “Debt-to-Income (DTI) Trap.” When you apply for a loan—be it a credit card, auto loan, or mortgage—lenders focus heavily on your Gross Income. This often gives you a higher DTI capacity on paper than you can actually manage.

However, you must use your Net Income to determine what you can realistically and comfortably afford to pay toward all debts each month without jeopardizing your basic living expenses. Basing debt payments on your Gross Income is a primary driver of financial stress and insolvency.

Generating a Debt Surplus

The goal of a Net Income budget is to generate a surplus—money left over after all necessary expenses and savings are covered. This surplus is the direct ammunition you need to crush debt. As financial experts, we advise allocating this surplus strategically to the highest-interest debt first (the Avalanche Method) to minimize interest paid over time, or using the Snowball Method (paying off the smallest debt first) for psychological momentum.

Regardless of the tactic, your Net Income is the constant, reliable number that ensures your debt payments are sustainable, effective, and lead you toward true financial freedom.

Beyond the Basics: Financial Tips for the South Asian American Community

Achieving financial health in the US often requires balancing domestic goals with family responsibilities abroad. By grounding your budget in your Net Income, you can strategically manage these unique financial pressures.

Integrating Overseas Commitments

For many, sending remittances back home is a vital, non-negotiable expense. Do not treat this as a variable or “extra” cost. Instead, treat the monthly amount you send home as a mandatory budget line item, funding it directly from your Net Income, just like rent or a utility bill. Budgeting for it upfront ensures you don’t compromise your US financial stability.

Planning for Cultural Investments

The long-term goals of saving for property back home or funding your children’s education are powerful motivators. To achieve them, fully integrate these savings into your Net Income budget. For US-based educational goals, utilize tax-advantaged tools like 529 plans. By treating savings as a fixed cost, you secure your future without accumulating debt today.

Leveraging Pre-Tax Deductions

A smart debt avoidance strategy involves maximizing pre-tax deductions, such as contributions to your 401(k) or health savings accounts. Every dollar you contribute pre-tax reduces your taxable gross income. This means you pay less in taxes and increase the efficiency of your Net Income, creating more room to pay down high-interest debt.

Conclusion

The foundational lesson is simple: Gross Income is your starting point, but Net Income is your indispensable budget number. Mistaking one for the other is a common financial pitfall that leads to debt and stress.

You now know to calculate your true financial foundation. Don’t guess; calculate and act. If you are struggling with debt or need help tailoring a precise financial plan based on your actual Net Income and unique family goals, consulting a professional debt relief expert can provide the custom strategy and support you need to secure a prosperous, debt-free future.