Taking the first step toward seeking debt relief is a sign of financial strength, not failure. However, the term "debt relief" is broad, covering several very different strategies, and choosing the wrong path can set you back significantly. For many South Asian Americans, the pressure to manage finances responsibly—often supporting family abroad while navigating high costs of living in the US—makes selecting the right solution even more crucial. Before you begin to evaluate any company, you must first understand the fundamental options available. This essential knowledge will protect you from predatory practices and…continue reading →

Debt

Is a HELOC a Good Way to Consolidate Debt?

The stress of high-interest debt—like revolving balances on credit cards or expensive personal loans—can feel overwhelming. Many South Asian American families, dedicated to the long-term goal of financial stability, often look for intelligent ways to manage or eliminate these unsecured debts. One popular option that frequently comes up in conversations about debt consolidation is a Home Equity Line of Credit (HELOC). For our community, the decision to use a HELOC carries significant weight. Homeownership, whether it’s a single-family home or an investment property, is often the cornerstone of multi-generational financial planning and success.…continue reading →

How To Choose A Reputable Tax Resolution Company?

Facing an unexpected IRS notice or dealing with the burden of tax debt can be one of the most stressful experiences for any American. The moment you realize your financial situation requires professional intervention is the moment you need reliable, trustworthy guidance. This guide is designed to empower you to choose the right professional partner—a reputable tax resolution company—that can help you navigate these complex challenges with confidence and integrity. For the South Asian community in the US, the stakes are often even higher. As immigrants, professionals on H-1B visas, or successful small…continue reading →

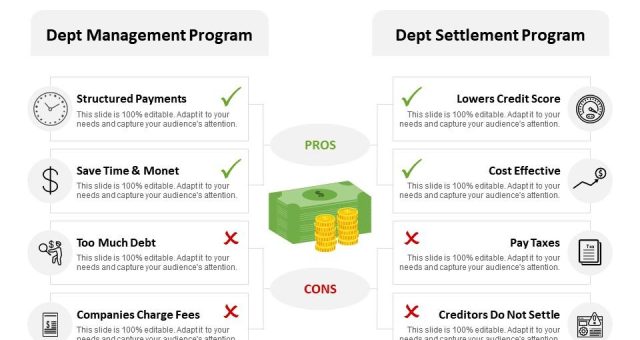

Debt Management Vs Debt Settlement

The journey to financial success in America is often complicated for South Asian Americans. Many navigate a unique set of pressures, from balancing family expectations for wealth and support to managing the financial demands of remittances sent back home or the complex commitment of co-signing loans for relatives. Amidst these responsibilities, high-interest unsecured debt—like credit cards—can quickly become overwhelming. For a community that often prioritizes reputation and financial stability, being trapped in debt carries not only a financial burden but a significant emotional one. The good news is that you have options to…continue reading →

Corporate Debt Restructuring 6 Strategies To Save Your Business

For South Asian entrepreneurs in the US, running a business is often a deep personal commitment—a source of pride and a legacy for the family. When mounting corporate debt threatens that foundation, the pressure can feel overwhelming, compounded by a cultural anxiety around financial failure. You are not alone, and reaching out for help is a sign of strength, not weakness. Financial distress does not have to be the end of your enterprise. It is often a critical inflection point demanding strategic action. This action is known as Corporate Debt Restructuring (CDR). CDR…continue reading →

Can Capital Business Loan Review: We Did The Research

In the high-stakes world of American small business, entrepreneurs from the South Asian diaspora face a unique set of financial pressures. The commitment to building a life here is often compounded by cultural expectations of success, the complex balancing act of sending remittances home, and sometimes, the additional hurdle of navigating business financing while on complex visa or green card journeys, making access to traditional capital a challenge. When cash flow demands quick action, alternative lenders like Can Capital often appear as the fastest lifeline. But is fast money the same as good…continue reading →

Business Debt Relief What Are Your Options

Starting a small family business or launching a first-generation venture in the United States is a source of immense pride, not just for you, but for your entire community. As a South Asian American entrepreneur, you embody resilience, hard work, and the pursuit of the American Dream. Yet, the reality of running a business often involves heavy burdens, and chief among them is debt. If you are currently facing overwhelming business debt from maxed-out credit lines to mounting vendor bills, you are not alone, and it is not a sign of failure. It…continue reading →

Am I Liable For My Spouses Tax Debt?

Receiving an unexpected notice from the IRS demanding payment for a tax debt accrued on a joint return can be a moment of extreme financial distress and confusion. The question that immediately comes to mind is both urgent and profound: Am I liable for my spouse’s tax debt? The short, but often frustrating, answer is: It depends. For many U.S.-based South Asian families, where joint financial planning and familial trust are deeply held values, a question of shared liability is not just a matter of law, but one that touches on the very…continue reading →

All About Bankruptcy In Delaware And How It Can Be Avoided

The weight of financial distress is heavy, and for many South Asian Americans, that burden is compounded by a deep-seated cultural stigma. There is a profound pressure to succeed, to maintain status, and to shield the family from any sign of struggle. If you are residing in Delaware and feel this pressure, know this: seeking a solution is not a failure; it is an act of courage and strength. Taking control of your financial health is the most responsible action you can take for your family's future. As a professional financial management and…continue reading →

Alabama Al Debt Relief Useful Solutions To Your Financial Burden With Ooraa

For many South Asian individuals and families residing in the US, financial success is viewed not just as a personal goal but as a family obligation. Yet, beneath the surface of hard work and community pride, a quiet and often heavy burden can weigh on households in places like Alabama: debt. The cultural pressure and pervasive stigma surrounding financial difficulty can make the problem feel isolating, leading people to suffer in silence rather than seek help. You may feel like you’re failing to meet expectations, but the truth is, you are not alone.…continue reading →

- Previous Posts

- 1

- …

- 6

- 7

- 8

- 9

- 10

- 11

- Next Posts