Debt, at any level, casts a heavy shadow, but when you are an Iowa resident juggling the costs of living, family obligations, and unexpected expenses, that financial strain can feel overwhelming. For many, especially within the South Asian community in the US, the stress of debt is compounded by cultural pressure and the aspiration to provide for both immediate and extended family. You are not alone in seeking a way out—nearly 40% of Iowa households are struggling to afford basic necessities despite working. This is where the right solution can make all the…continue reading →

Debt Negotiation

Indiana Debt Consolidation Can All Consumer Debt Be Consolidated

Moving to the United States is a journey filled with opportunity, but for many South Asian families in Indiana, it comes with unique financial pressures. The commitment to supporting family members abroad, the cultural expectations surrounding financial success, and the challenge of navigating an unfamiliar credit and debt system can quickly lead to stress and mounting obligations. You work hard, you save diligently, yet high-interest consumer debt—from credit cards to personal loans—can feel like a heavy anchor. The good news is that millions of Americans have successfully utilized debt consolidation as a powerful…continue reading →

How To Deal With Aggressive Debt Collectors Your Rights And Action Plan

When the phone rings and a collector is on the line, it can feel like your financial life is spiraling out of control. It's important to recognize that seeking debt relief or dealing with collection issues is a financial situation, not a moral failure. For many South Asian Americans, the stress is intensified by a cultural emphasis on preserving financial reputation and the fear that debt issues could impact visa status, permanent residency applications, or even family standing both here and abroad. We understand these unique pressures, and your well-being is the priority.…continue reading →

How To Choose A Reputable Debt Relief Company

Taking the first step toward seeking debt relief is a sign of financial strength, not failure. However, the term "debt relief" is broad, covering several very different strategies, and choosing the wrong path can set you back significantly. For many South Asian Americans, the pressure to manage finances responsibly—often supporting family abroad while navigating high costs of living in the US—makes selecting the right solution even more crucial. Before you begin to evaluate any company, you must first understand the fundamental options available. This essential knowledge will protect you from predatory practices and…continue reading →

How To Choose A Reputable Tax Resolution Company?

Facing an unexpected IRS notice or dealing with the burden of tax debt can be one of the most stressful experiences for any American. The moment you realize your financial situation requires professional intervention is the moment you need reliable, trustworthy guidance. This guide is designed to empower you to choose the right professional partner—a reputable tax resolution company—that can help you navigate these complex challenges with confidence and integrity. For the South Asian community in the US, the stakes are often even higher. As immigrants, professionals on H-1B visas, or successful small…continue reading →

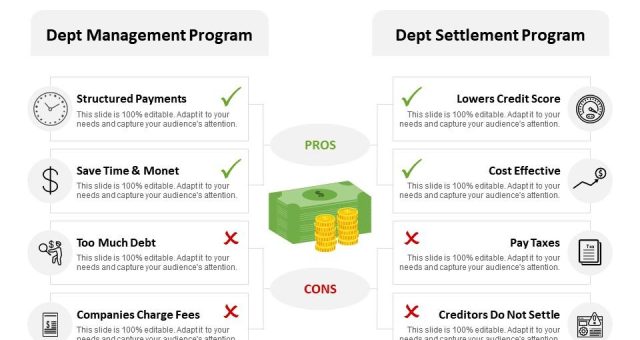

Debt Management Vs Debt Settlement

The journey to financial success in America is often complicated for South Asian Americans. Many navigate a unique set of pressures, from balancing family expectations for wealth and support to managing the financial demands of remittances sent back home or the complex commitment of co-signing loans for relatives. Amidst these responsibilities, high-interest unsecured debt—like credit cards—can quickly become overwhelming. For a community that often prioritizes reputation and financial stability, being trapped in debt carries not only a financial burden but a significant emotional one. The good news is that you have options to…continue reading →

Business Debt Relief What Are Your Options

Starting a small family business or launching a first-generation venture in the United States is a source of immense pride, not just for you, but for your entire community. As a South Asian American entrepreneur, you embody resilience, hard work, and the pursuit of the American Dream. Yet, the reality of running a business often involves heavy burdens, and chief among them is debt. If you are currently facing overwhelming business debt from maxed-out credit lines to mounting vendor bills, you are not alone, and it is not a sign of failure. It…continue reading →

Alabama Al Debt Relief Useful Solutions To Your Financial Burden With Ooraa

For many South Asian individuals and families residing in the US, financial success is viewed not just as a personal goal but as a family obligation. Yet, beneath the surface of hard work and community pride, a quiet and often heavy burden can weigh on households in places like Alabama: debt. The cultural pressure and pervasive stigma surrounding financial difficulty can make the problem feel isolating, leading people to suffer in silence rather than seek help. You may feel like you’re failing to meet expectations, but the truth is, you are not alone.…continue reading →

Why Paying Only The Minimum Keeps You In Debt Longer?

For many South Asian individuals and families residing in the USA, financial stability is not just a personal goal—it’s a deeply held cultural value rooted in providing security for the family, supporting relatives back home, and achieving the American dream. This strong commitment often drives immense ambition, but it also creates unique financial pressures. Between managing high living costs, sending remittances, and navigating a complex credit system, the path to financial peace can be challenging. When debt piles up, the immediate reaction is often to seek the path of least resistance: paying only…continue reading →

Louisiana Debt Relief Programs for the South Asian Community in the USA

In the journey of building a life in the United States, South Asian families often navigate a complex financial landscape. The deep-rooted values of supporting family—both here and in your home country along with the financial demands of weddings, education, and other cultural obligations, can create significant financial pressure. While debt is a common part of life for many, the stigma associated with it in our community can make it feel like a private burden you must carry alone. But it doesn't have to be. This guide is designed to be a clear,…continue reading →