When dealing with overwhelming unsecured debt, finding a clear, trustworthy path to relief is paramount. The appearance of a company like "Option 1 Legal" in your search results—promising negotiation and settlement—can feel like a much-needed lifeline. However, in the high-stakes world of debt relief, where your money and reputation are on the line, the question of "Is it legit?" is far more complex than a simple yes or no. For South Asian American families, who often manage financial decisions with deep consideration for community standing, family honor, and future stability, the risks associated…continue reading →

Debt Consolidation

Merchant Cash Advancemca Loan The Drawbacks You Should Be Aware Of

For the hardworking South Asian small business owner in the USA—whether you run a local convenience store, a deli, or a bustling hospitality venture—the need for quick capital to bridge a gap or seize an opportunity is a constant pressure. When traditional bank loans move too slowly, the Merchant Cash Advance (MCA) appears as a beacon of speed and simplicity, offering funds in days, not weeks. However, as a professional financial management expert, I must caution you: the speed and ease of an MCA often come at a cost that is far higher…continue reading →

Liberty Debt Relief Review Are Second Opinions Necessary

The pressure of overwhelming debt is a heavy weight, often bringing with it a profound fear of financial insecurity. For many in the South Asian American community, this stress is magnified by the cultural significance of maintaining a strong reputation and the practical reality that financial stability directly impacts everything from immigration status to the family's ability to finance businesses and future generations. The need for a reliable, discreet solution is paramount, but the debt relief industry itself can feel opaque and risky. Because financial services are highly sensitive and directly impact your…continue reading →

Iowa Ia Debt Relief Reliable Cure To Your Financial Woes With Ooraadebt

Debt, at any level, casts a heavy shadow, but when you are an Iowa resident juggling the costs of living, family obligations, and unexpected expenses, that financial strain can feel overwhelming. For many, especially within the South Asian community in the US, the stress of debt is compounded by cultural pressure and the aspiration to provide for both immediate and extended family. You are not alone in seeking a way out—nearly 40% of Iowa households are struggling to afford basic necessities despite working. This is where the right solution can make all the…continue reading →

Indiana Debt Consolidation Can All Consumer Debt Be Consolidated

Moving to the United States is a journey filled with opportunity, but for many South Asian families in Indiana, it comes with unique financial pressures. The commitment to supporting family members abroad, the cultural expectations surrounding financial success, and the challenge of navigating an unfamiliar credit and debt system can quickly lead to stress and mounting obligations. You work hard, you save diligently, yet high-interest consumer debt—from credit cards to personal loans—can feel like a heavy anchor. The good news is that millions of Americans have successfully utilized debt consolidation as a powerful…continue reading →

How To Deal With Aggressive Debt Collectors Your Rights And Action Plan

When the phone rings and a collector is on the line, it can feel like your financial life is spiraling out of control. It's important to recognize that seeking debt relief or dealing with collection issues is a financial situation, not a moral failure. For many South Asian Americans, the stress is intensified by a cultural emphasis on preserving financial reputation and the fear that debt issues could impact visa status, permanent residency applications, or even family standing both here and abroad. We understand these unique pressures, and your well-being is the priority.…continue reading →

Is a HELOC a Good Way to Consolidate Debt?

The stress of high-interest debt—like revolving balances on credit cards or expensive personal loans—can feel overwhelming. Many South Asian American families, dedicated to the long-term goal of financial stability, often look for intelligent ways to manage or eliminate these unsecured debts. One popular option that frequently comes up in conversations about debt consolidation is a Home Equity Line of Credit (HELOC). For our community, the decision to use a HELOC carries significant weight. Homeownership, whether it’s a single-family home or an investment property, is often the cornerstone of multi-generational financial planning and success.…continue reading →

How To Choose A Reputable Tax Resolution Company?

Facing an unexpected IRS notice or dealing with the burden of tax debt can be one of the most stressful experiences for any American. The moment you realize your financial situation requires professional intervention is the moment you need reliable, trustworthy guidance. This guide is designed to empower you to choose the right professional partner—a reputable tax resolution company—that can help you navigate these complex challenges with confidence and integrity. For the South Asian community in the US, the stakes are often even higher. As immigrants, professionals on H-1B visas, or successful small…continue reading →

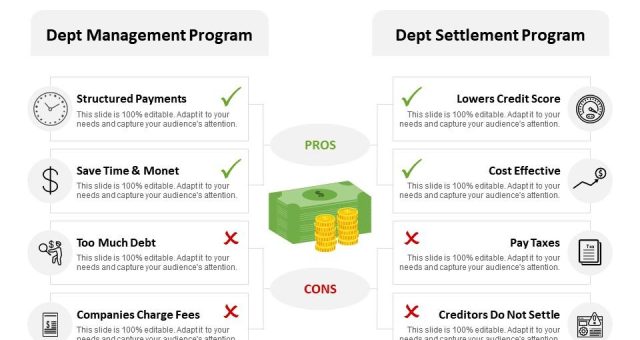

Debt Management Vs Debt Settlement

The journey to financial success in America is often complicated for South Asian Americans. Many navigate a unique set of pressures, from balancing family expectations for wealth and support to managing the financial demands of remittances sent back home or the complex commitment of co-signing loans for relatives. Amidst these responsibilities, high-interest unsecured debt—like credit cards—can quickly become overwhelming. For a community that often prioritizes reputation and financial stability, being trapped in debt carries not only a financial burden but a significant emotional one. The good news is that you have options to…continue reading →

Business Debt Relief What Are Your Options

Starting a small family business or launching a first-generation venture in the United States is a source of immense pride, not just for you, but for your entire community. As a South Asian American entrepreneur, you embody resilience, hard work, and the pursuit of the American Dream. Yet, the reality of running a business often involves heavy burdens, and chief among them is debt. If you are currently facing overwhelming business debt from maxed-out credit lines to mounting vendor bills, you are not alone, and it is not a sign of failure. It…continue reading →

- Previous Posts

- 1

- 2

- 3

- 4

- 5

- 6

- Next Posts