For many in the South Asian diaspora, the American dream is built on a foundation of hard work, high-earning potential, and upward mobility. However, beneath the surface of professional success, a "hidden" crisis often brews: mounting credit card debt. Whether it stems from the high costs of settling in the USA, supporting family back home through remittances, or the immense pressure to maintain certain social expectations, debt can quickly become a suffocating weight. Ignoring those rising balances might feel like a temporary relief, but it is a dangerous strategy. In the American financial…continue reading →

Credit

How Many Credit Cards Should I Have? A Comprehensive Guide

Navigating the US financial landscape can feel overwhelming, especially when managing money across continents. For South Asian individuals building a life in America, questions about credit are particularly critical. You might be supporting family abroad, planning large investments, or simply trying to maximize your financial security in a new system. This leads to one of the most common and crucial questions: "How many credit cards should I really have?" As a debt relief and financial management expert with experience guiding the South Asian community in the US, I can tell you there is…continue reading →

Credit Counseling Vs. Debt Settlement: Pros And Cons

The journey to financial prosperity in the United States, especially for South Asian immigrants and first-generation Americans, often comes with unique challenges. The drive to succeed, support family both here and abroad, and invest in a better future can sometimes lead to accumulating substantial debt in a complex U.S. financial system. You've worked hard to build a life here, and carrying the weight of credit card balances, personal loans, or medical bills can be incredibly stressful, impacting not just your bank account but your mental peace. This stress is often compounded by cultural…continue reading →

If You’re Struggling With Credit Card Addiction, Try These Debt Relief Options

The stress of mounting credit card debt is immense, but when that debt stems from an irresistible urge to spend, the struggle often becomes a deeply isolating emotional battle.1 You may feel helpless and alone, recognizing the problem but feeling powerless to stop the cycle. This challenge is rooted not just in poor budgeting, but in behavioral patterns used to cope with underlying emotions.2 For members of the South Asian community, this struggle carries an even heavier weight. The intense cultural stigma surrounding financial difficulty can magnify feelings of shame, making it nearly…continue reading →

Credit Card Debt Forgiveness: What Is It And Who Qualifies?

The journey to financial prosperity in the United States is often marked by hard work and dedication, especially within the vibrant South Asian diaspora. However, alongside the pressures of professional life, new challenges can emerge, including navigating the complexities of credit and managing high-interest debt. For many in our community, there is the added burden of cultural expectations, such as family financial responsibilities and supporting relatives through remittance back home, which can inadvertently lead to significant credit card balances and feelings of financial hardship. When the debt burden becomes overwhelming, the idea of…continue reading →

Repair Bad Credit In 6 Easy Steps

Seeing a low credit score can feel like a tremendous obstacle, but it is crucial to recognize that bad credit is often a temporary setback, not a permanent status. This is especially true when navigating a new, complex financial system like the U.S., which operates differently from those in South Asia. The road to unexpected credit damage often begins with unique pressures. Perhaps you have a newer immigrant status, meaning your positive financial history outside the U.S. doesn't factor in. Maybe you generously co-signed for a family member, only to be hit by…continue reading →

3 Surefire Ways To Consolidate Credit Card Debt Or Payments

In the pursuit of the American Dream, debt can often feel like a deeply private burden, especially within the South Asian American community. For many, the financial pressure is compounded by unique cultural and familial obligations. You are navigating the dual responsibilities of establishing a secure life in the U.S. while often supporting family back home—a delicate balancing act where credit card balances can quietly spiral out of control. This pressure is intensified by the expectation of maintaining certain standards or "keeping up appearances." Discussing financial stress or debt is often seen as…continue reading →

How Does Credit Consolidation Work?

The American Dream often comes with a financial learning curve, especially for the vibrant South Asian community residing in the USA. Your journey is unique: you may be navigating the delicate balance of intergenerational expectations regarding wealth, managing remittance responsibilities back home, all while simultaneously trying to build a strong, reliable U.S. credit history from a financial foundation rooted elsewhere. This blend of cultural commitment and new-world finance can sometimes lead to accumulating multiple high-interest debts, making the path to stability feel overwhelming. If you find yourself juggling payments on several credit cards,…continue reading →

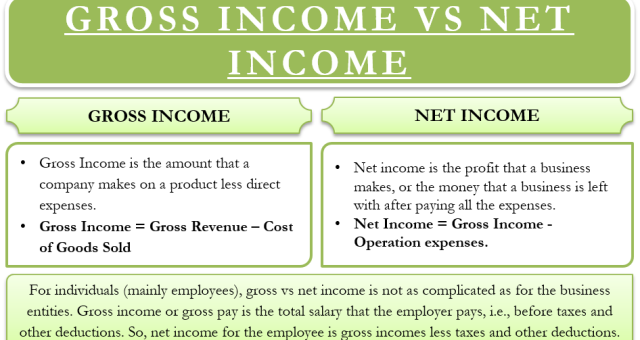

Gross or Net Income: What Is The Difference?

Are you tracking your expenses against the wrong number? For South Asian families balancing remittances, property investments back home, and the rising cost of living in the USA, confusing your Gross and Net income can lead to significant financial setbacks and increased debt. Managing finances in the US is uniquely complex, especially when navigating a new tax system and balancing overseas financial commitments with local expenses. Many professionals, whether recently arrived or established, make the critical mistake of budgeting with the large, impressive number—your Gross Income—only to find their bank account short at…continue reading →

Should You Refinance Credit Card Debt in 2025?

If you're reading this, you're likely grappling with the weight of credit card debt. The late fees, the high-interest rates, and the seemingly endless monthly payments can feel overwhelming, creating a cloud of stress that affects every part of your life. We understand this burden, and we want to assure you that you are not alone on this journey. For over two decades, we have helped thousands of individuals and families navigate these exact challenges, guiding them toward a path of financial stability. We understand the unique pressures and aspirations of hardworking individuals,…continue reading →

- 1

- 2

- Next Posts