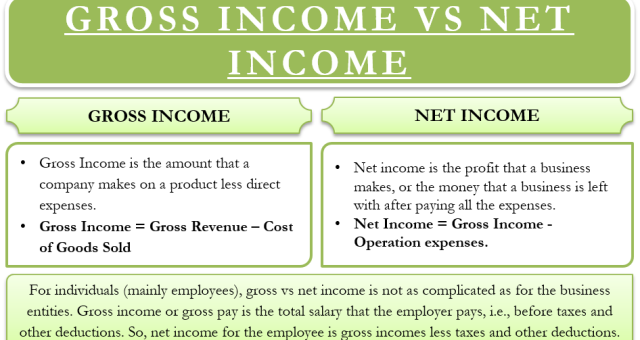

Are you tracking your expenses against the wrong number? For South Asian families balancing remittances, property investments back home, and the rising cost of living in the USA, confusing your Gross and Net income can lead to significant financial setbacks and increased debt. Managing finances in the US is uniquely complex, especially when navigating a new tax system and balancing overseas financial commitments with local expenses. Many professionals, whether recently arrived or established, make the critical mistake of budgeting with the large, impressive number—your Gross Income—only to find their bank account short at…continue reading →

Author: Bhupinder Bajwa

Funding Circle Business Loan Review: Information You Should Know

Securing the right funding is a make-or-break moment for any small business in the US, especially for the vibrant community of South Asian American entrepreneurs navigating a complex financial landscape. This decision is not just about growth; it’s about managing debt responsibly and protecting your personal financial health. As a financial management expert specializing in debt relief and business structuring, I bring over 10 years of experience directly evaluating alternative lending platforms like Funding Circle. My commitment is to provide a transparent, expert-led analysis that cuts through the marketing and focuses on the…continue reading →

Explanation Debt Settlement Affect Credit

Debt can feel overwhelming, especially when navigating the complex financial landscape of the United States while balancing family obligations and expectations. If monthly payments have become unsustainable, you may be considering debt settlement—a process where a creditor agrees to accept a lump sum lower than the total amount owed. While this path offers immediate, much-needed relief and a clear end to persistent collection calls, it is crucial to understand that it comes at a significant cost to your credit profile. As a financial management professional, I want to provide you with an honest,…continue reading →

How To Choose A Reputable Tax Resolution Company?

Facing an unexpected IRS notice or dealing with the burden of tax debt can be one of the most stressful experiences for any American. The moment you realize your financial situation requires professional intervention is the moment you need reliable, trustworthy guidance. This guide is designed to empower you to choose the right professional partner—a reputable tax resolution company—that can help you navigate these complex challenges with confidence and integrity. For the South Asian community in the US, the stakes are often even higher. As immigrants, professionals on H-1B visas, or successful small…continue reading →

Debt Relief Program: What To Expect?

The weight of debt can feel immense, a silent source of stress that often clashes with the deeply rooted cultural expectation of izzat, honor, and financial stability common within the South Asian community. For many South Asian Americans, managing the high cost of living, supporting family back home through remittances, and upholding community standing while facing mounting US debt can feel like an impossible balancing act. The fear of judgment or bringing 'shame' often prevents people from seeking the critical help they need. You are not alone. As experienced financial professionals, we understand…continue reading →

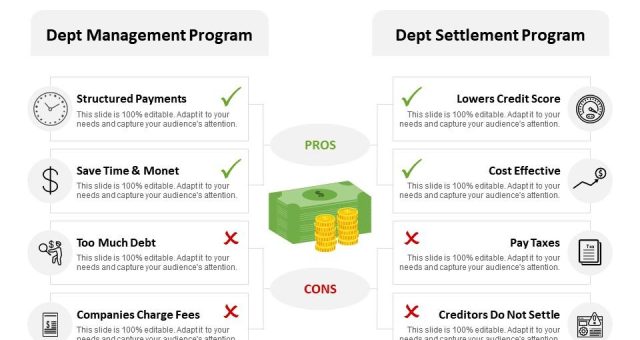

Debt Management Vs Debt Settlement

The journey to financial success in America is often complicated for South Asian Americans. Many navigate a unique set of pressures, from balancing family expectations for wealth and support to managing the financial demands of remittances sent back home or the complex commitment of co-signing loans for relatives. Amidst these responsibilities, high-interest unsecured debt—like credit cards—can quickly become overwhelming. For a community that often prioritizes reputation and financial stability, being trapped in debt carries not only a financial burden but a significant emotional one. The good news is that you have options to…continue reading →

Corporate Debt Restructuring 6 Strategies To Save Your Business

For South Asian entrepreneurs in the US, running a business is often a deep personal commitment—a source of pride and a legacy for the family. When mounting corporate debt threatens that foundation, the pressure can feel overwhelming, compounded by a cultural anxiety around financial failure. You are not alone, and reaching out for help is a sign of strength, not weakness. Financial distress does not have to be the end of your enterprise. It is often a critical inflection point demanding strategic action. This action is known as Corporate Debt Restructuring (CDR). CDR…continue reading →

Can The Irs Take Your Pension? What You Need To Know

The question, "Can the IRS take your pension?" has a critical and complex answer: Yes, the Internal Revenue Service (IRS) can legally levy or garnish your pension and retirement income, but only under specific circumstances that distinguish it from nearly all other creditors. This distinction is vital for your financial security. While the Employee Retirement Income Act (ERISA) and other federal and state laws provide significant protection for your retirement assets (401(k)s, IRAs, and traditional pensions) from general creditors like credit card companies or lenders, federal tax debt is one of the few…continue reading →

Can Capital Business Loan Review: We Did The Research

In the high-stakes world of American small business, entrepreneurs from the South Asian diaspora face a unique set of financial pressures. The commitment to building a life here is often compounded by cultural expectations of success, the complex balancing act of sending remittances home, and sometimes, the additional hurdle of navigating business financing while on complex visa or green card journeys, making access to traditional capital a challenge. When cash flow demands quick action, alternative lenders like Can Capital often appear as the fastest lifeline. But is fast money the same as good…continue reading →

Business Debt Relief What Are Your Options

Starting a small family business or launching a first-generation venture in the United States is a source of immense pride, not just for you, but for your entire community. As a South Asian American entrepreneur, you embody resilience, hard work, and the pursuit of the American Dream. Yet, the reality of running a business often involves heavy burdens, and chief among them is debt. If you are currently facing overwhelming business debt from maxed-out credit lines to mounting vendor bills, you are not alone, and it is not a sign of failure. It…continue reading →

- Previous Posts

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 19

- Next Posts